Cpcu 520

CPCU 520, Apr 15 - Jun 30, 2020: Institutes Approved On-Site Testing Centers Register through Jun 30, 2020: Prometric Test Center Early Registration. Retain key concepts and convert them into on-the-job actions with the new online CPCU personal and commercial coverage courses. The new learning experience features shortened and refreshed content, subject matter expert videos and insights, and enhanced exam prep tools that better prepare you for exam day. A special set of cards dedicated to 520 formulas. CPCU 520: Formulas study guide by cydley includes 41 questions covering vocabulary, terms and more. Quizlet flashcards, activities and games help you improve your grades. The CPCU 520 exam questions, similar to the CPCU 500 exam questions, require you to fully understand and apply every minor detail of the ten major CPCU 520 topics. When I say you must be able to apply your knowledge from these topics, I mean these questions will put you in the shoes of an insurance professional; it will be your job to analyze. Marc Cleary, CPCU, ARM Class Dates Meets 12 Wednesdays, beginning January 29, 2020 from 4:00 to 5:30 PM. Location ONLINE via GoToWebinar.

CPCU Study Guides

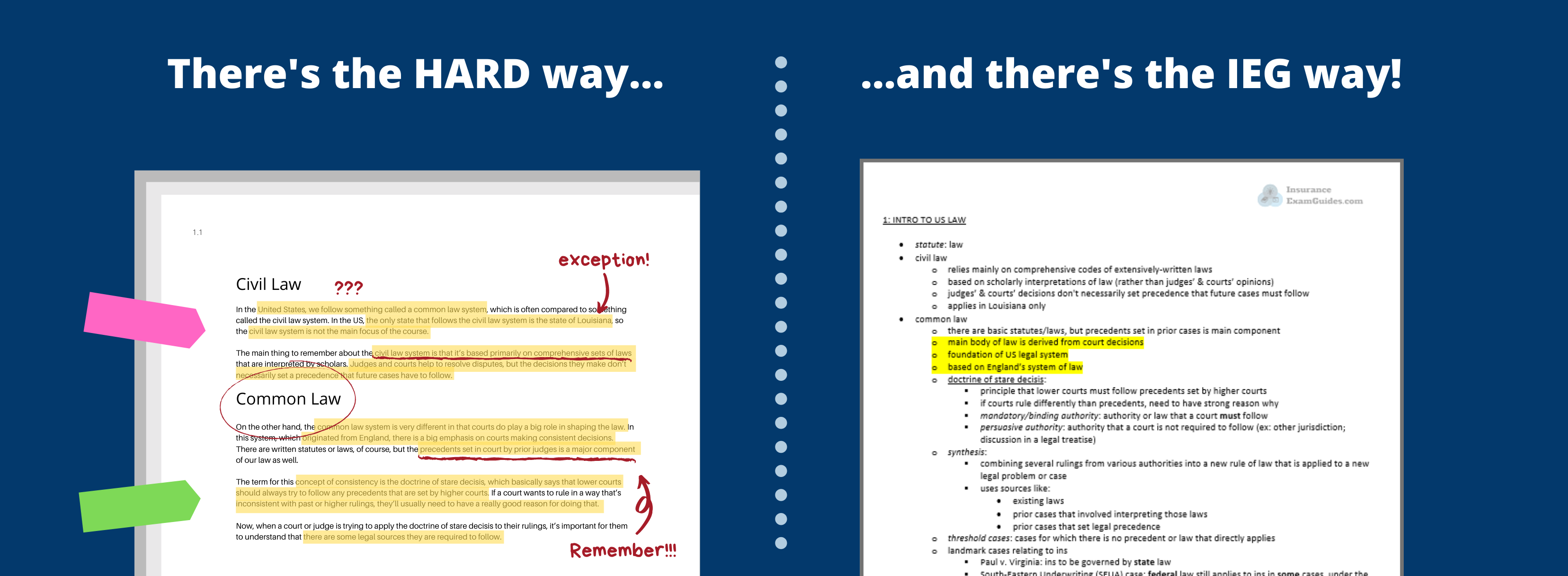

To pass your test, you must have an efficient way to review all the material covered in the course. Our study guides are designed with this in mind, outlining all the necessary concepts in as few pages per chapter as possible.

CPCU Online Courses

Our online courses have everything you need to fully prepare for your exam: video/audio lectures, our popular study guides & bonus printables, chapter quizzes, and a full-length practice exam. Currently available for CPCU 530 & CPCU 540.

A commonly-asked question about the CPCU® program is what order you should take the classes in. Since none of the classes have a prerequisite, you can take them in whatever order you want. That said, we recommend taking CPCU 520 (Insurance Operations)right before CPCU 540 (Finance & Accounting for Insurance Professionals)for these reasons:

#1: You’ll learn key terminology & concepts in CPCU 520 that are used in CPCU 540

CPCU 520 examines how an insurance company works by taking a detailed look at each of the main departments or functions of an insurance carrier, such as claims, underwriting, reinsurance, etc. Many of the terms you are introduced to in CPCU 520 are used in the discussions throughout CPCU 540, so already knowing the vocabulary means you don’t have to stop to look things up. And, when they discuss how a certain department’s activities could impact an insurance company’s financials, you’ll already have an understanding or frame of reference for the activities they are referring to because you already learned about those departments in CPCU 520.

Make sure you review the SMART way for your CPCU exam!

Each CPCU course covers a TON of material, and having a way to efficiently review it all to refresh your memory is CRUCIAL to passing your exam. Our famous study guides are the perfect way to quickly and easily brush up on all the key concepts before it's time to take your test, WITHOUT having to reread all the material again. Just look at the difference below:

#2: CPCU 520 includes an entire chapter on insurance regulation, which is a driving force behind financial reporting requirements

You’ll come to realize in CPCU 540 that governments heavily regulate how insurance companies are required to track and report their financial information. Most of CPCU 540 is explanations of how certain financial reporting requirements satisfy what the government is trying to accomplish with their insurance regulations. Chapter two of CPCU 520 is devoted entirely to the reasons for government regulation, so it provides a great introduction for better understanding the “why” behind all the financial reporting guidelines covered in CPCU 540.

#3: CPCU 520 already introduces to you how an insurance company operates financially

In CPCU 520, you’ll learn the basics of how an insurance company makes money and what some of the key financial measures are that help you monitor an insurance carrier’s performance. Again, what you learn about in CPCU 520 thus helps serve as a foundation to the much more detailed exploration you will make in CPCU 540.

#4: The same formulas from CPCU 520 appear again in CPCU 540

Many people are intimidated by the idea of memorizing and applying math formulas, and there are a lot of them in CPCU 540. But a good chunk of them are already included inCPCU 520, so it’s basically like splitting the formulas into two sections if you do the courses one right after the other. Work on memorizing the formulas in CPCU 520, master them & pass that exam, then while they are fresh in your mind you can go right into CPCU 540 and finish memorizing the rest of them.

Side note: we also have a separate blog post with a step-by-step plan for how exactly to tackle any CPCU formulas, which you can view by clicking HERE.

But, also consider this:

CPCU 540 is pretty challenging – it has a reputation as “The Beast” for a reason. It will likely take more time and effort than you’ve had to invest for your prior courses, so plan accordingly!

Let us help you tackle CPCU 520 then CPCU 540!

But now you know how to leverage what you learn in CPCU 520 to improve your comprehension of CPCU 540.

CPCU 520 Study Guide e-Bundle – Only $24.99

Cpcu 520 Test

- For use with 1st edition course of CPCU 520: Connecting the Business of Insurance Operations

- FREE updates (whenever we update our materials, you get access to the new version at no additional charge)

- Delivered by email as downloadable PDF

- For buyer's personal use only (non-transferrable and not for resale)

- Includes:

- Study guide

- BONUS: Formulas module

- BONUS: Formulas cheat sheet

- BONUS: How to Memorize CPCU Formulas

- BONUS: Comparison of Insurance Customers cheat sheet

- BONUS: Actuarial Word Problems worksheet

- BONUS: Types of Reinsurance chart

- BONUS: Reinsurance Practice Problems worksheet

Cpcu 520